Income statement is for specific duration – for year or a quarter. It tells about the revenue (sales), cost of goods sold, operating expenses and the profit by the company.

Income statement reflects the performance of the company on many fronts.

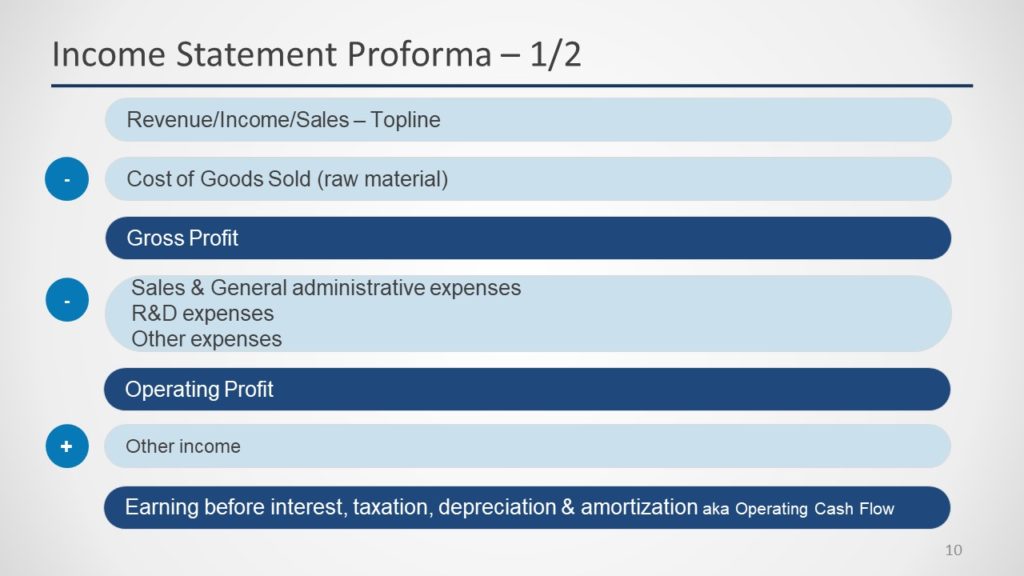

Income statements starts from revenue, topline or sales. Then COGS (Cost of Goods Sold is deducted). It gives the gross profit margin for the company.

A company need to take care of Sales and General Administrative expenses. Once deducted, we have operating profit. This is the edge of company.

Company can earn from other resources also which can be from investment or non core operation. This is termed as Other Income.

Operating Profit + Other Income = Earnings Before Interest, Taxation, Depreciation and Amortisation (EBITDA)

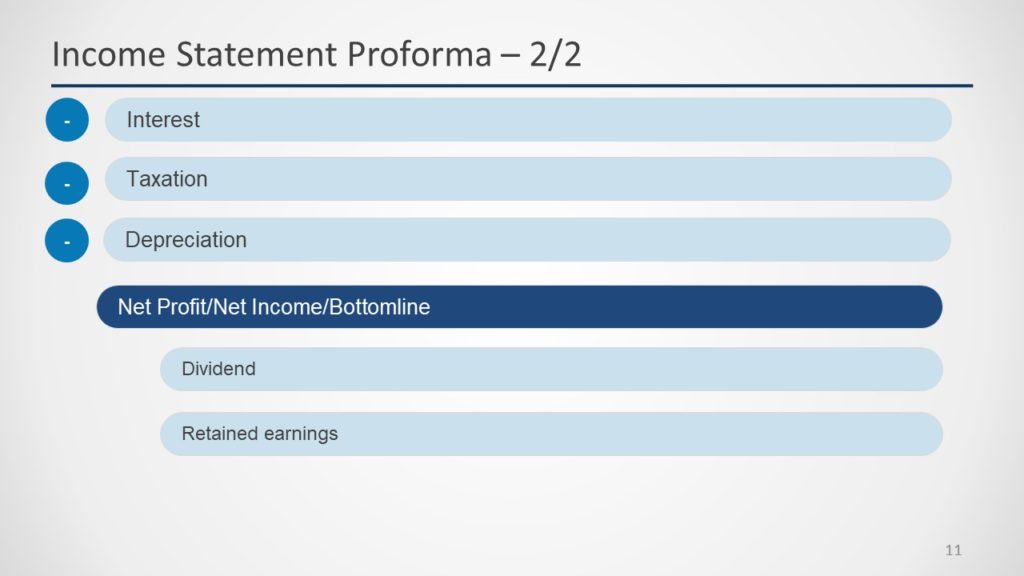

Interest, Taxation and Depriciation are other expenses deducted from EBITDA.

The remaining amount is called as the Net Profit or Net income. Its also called bottomline.

Topline and Bottomline tells the whole story of performance in specific period.

The net profit can be used to give

- Dividend back to shareholders

- Retained earning for future business growth (Best way for growth)

- Used to buy back the shares when they are cheap (Best way to enhance the shareholder return)