Balance Sheet – This is point in time statement of account with respect to asset of the company (what company owns) and the liability of the company (what company owes). It also shows, what is the networth of the shareholders – meaning what is owned by share holders. This is always presented as at date. For eg. Balance Sheet as at 31st March 2020.

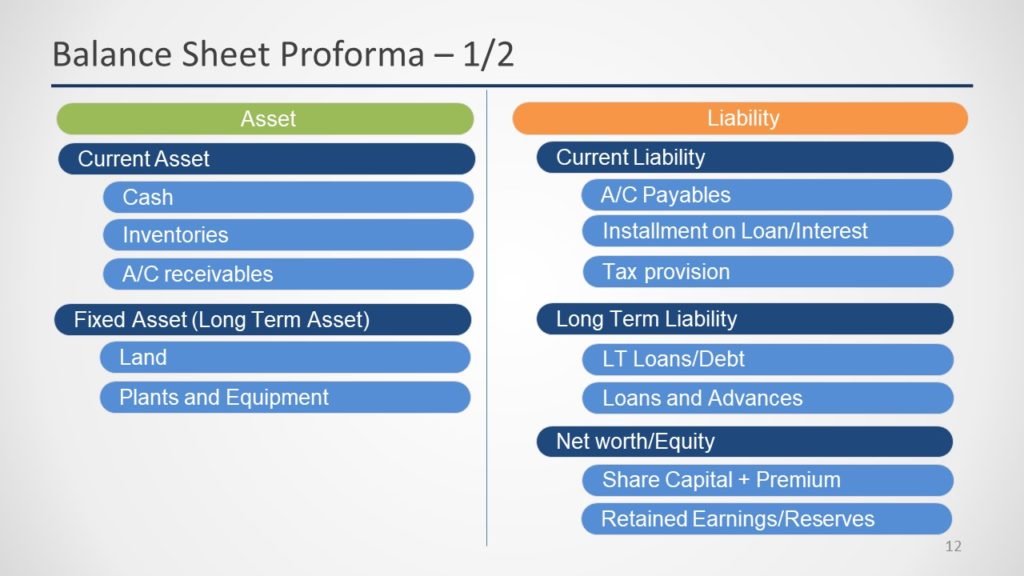

Balance Sheet is shown in two side format as follows.

- Asset represents – what is owned and controlled by a company.

- Liability – What company owes to others and also to Shareholders (Networth/Equity)

The Assets and Liability are listed in the form of liquidity. Current or High liquid items are listed on top and fixed items/long term are listed in bottom.

Current Asset – These are nothing but the cash, inventories and account receivables. A company should have more current asset than the current liability. This will ensure the liquidity within the business.

Fixed Asset – This are the productive long term asset utilised by company to perform the business. This is land, plants, equipment or machinary.

Fixed Asset is genreally represented as Gross Block (Cost at which asset is acquired) – Accumulated Depreciation = Net Block of asset.

All things equal, companies which requires less current asset and less fixed asset (also known as capital asset) represent superior quality business. Some industries by nature require lots of fixed asset and are called as capital intensive business.

Current Liability – What needs to be paid by company within next 12 month is called as current liability. Account Payables, Trades Payable, Interest, Tax provision, Salaries – all can be termed as the current liability.

Long Term Liabilty – The Long Term Loan, loans and advances given for long term is collated under long term liablility.

Net Worth/Equity – This essentially represents the shareholder funds. This has two components – Share Capital + Premium (what was seeded initially by the investor) + Retained Earnings (What was saved from profit since the starting of the company). This is termed as liability – since company owes this money to their shareholders.

Both Asset and Liabilty side should be balanced. That’s the most basic principle of the balanse sheet.

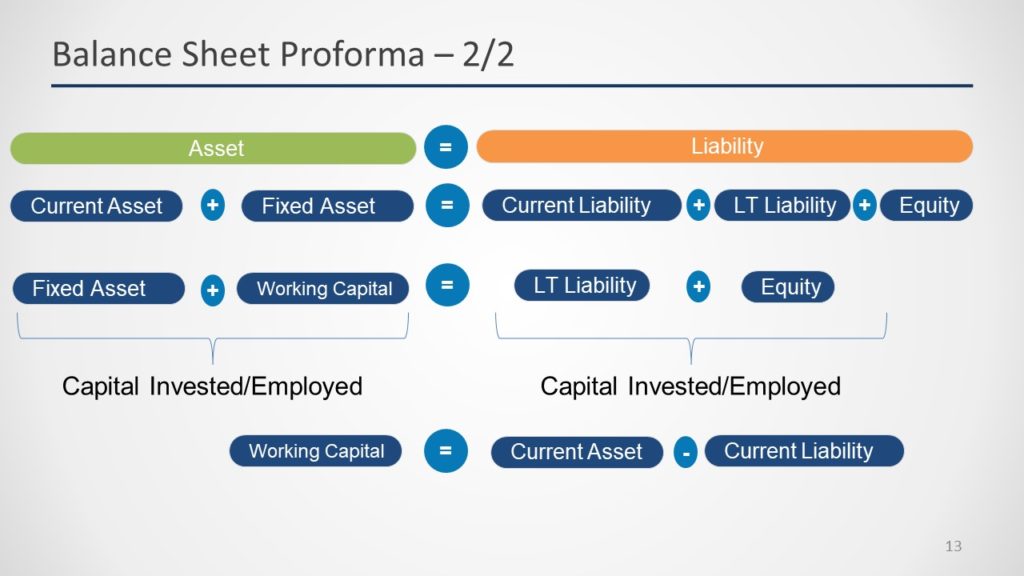

Working Capital = Current Asset – Current Liability

Fixed Asset + Working Capital is always equal to LT liability + Equity

This is also called as Capital Invested or Capital employed.